Market

Ngày thẻ Việt Nam 2: Truyền cảm hứng cho giới trẻ trong thanh toán không tiền mặt

Ngày 6/4 tại Hà Nội đã diễn ra buổi họp báo Công bố sự kiện Ngày Thẻ Việt Nam lần 2 (2022). Đây là chương trình được phối hợp tổ chức giữa Báo Tiền Phong và Công ty Cổ phần Thanh toán quốc gia Việt Nam (Napas), dưới sự chỉ đạo chỉ đạo của Ngân

Details

Nếu không thanh toán thẻ tín dụng có sao không?

Không thanh toán thẻ tín dụng gây ra nhiều hậu quả không tốt cho chủ thẻ, thậm chí chủ thẻ có thể bị truy cứu trách nhiệm dân sự hoặc trách nhiệm hình sự Số lượng người dùng sử dụng thẻ tín dụng ngày càng đông vì đây là hình thức thanh toán tiện lợi

Details

Smart card development history

A smart card, chip card, or integrated circuit card (ICC) is a pocket card typically the size of a credit card that contains an integrated circuit capable of storing and processing data. information. It can act as an identification card, perform information authentication, store data or be used in card applications. There are two main

Details

From today, ATM cards issued on the market must be chip cards

TTO – As of March 31st, banks are no longer issuing new domestic cards as magnetic cards to switch to chip cards. The cessation of issuing magnetic ATM cards is to comply with the provisions of Circular No. 22 on amending and supplementing a number of articles of Circular No. 19 on banking card operations.

Details

Stop issuing tape ATM cards

On March 31, credit institutions will terminate the issuance of magnetic ATM cards according to the roadmap of converting bank cards to domestic chip cards. According to the roadmap specified in Circular 22/2020 of the State Bank amending Circular 19/2016 regulating banking card operations, for card issuers from March 31st, stop issuing magnetic tape ATM

Details

Cash withdrawal at ATMs without using physical cards

Vietcombank applies QR technology to the ATM withdrawal service, helping customers withdraw money easily and quickly without having to carry a card … Vietcombank applies QR technology to its ATM withdrawal service, allowing customers to withdraw money easily and quickly without having to carry a card. Today, all Vietnamese people are no longer familiar with

Details

NCB is free to change magnetic card to chip card

NCB has just issued and converted magnetic cards to chip cards meeting VCCS standards for domestic debit cards … National Citizen Commercial Joint Stock Bank (NCB) has just issued and converted magnetic cards to chip cards meeting VCCS standards for domestic debit cards. Accordingly, all NCB domestic debit card holders will be free to change

Details

NCB issues domestic debit card that meets VCCS standard

In order to comply with the regulations on chip card facility standards in accordance with Circular 41/2018 / TT-NHNN, at the same time, enhance risk management in card business and operation of NCB and bring customers experience. many modern payment utilities, thereby improving card service quality, expanding and developing card business and digital banking. National

Details

Procedures to be issued with chip-attached citizen identification card

As a rule, when people make ID cards, they add chips in 4 convenient and fast steps. According to lawyer Nguyen Van Tien (Hanoi Bar Association), to create favorable conditions for citizens in the implementation of transactions, administrative reform towards the implementation of E-Government, Digital Government, Ministry of Public Security encourage citizens to change to

Details

SeABank invests in artificial intelligence, accelerates the digitization of banking operations

Considering digitalization as an important pillar in the bank’s development, Southeast Asia Commercial Joint Stock Bank (SeABank) has continuously upgraded its infrastructure, especially investing in a new artificial intelligence (AI) system. improve the customer experience and optimize the Bank’s operations at the same time. Since 2005, defining technology as a key factor to develop banking

Details

Domestic credit cards: Increasing convenience for customers, repelling black credit

The advantages of domestic credit cards have attracted customers’ attention and are expected to contribute to repelling black credit. In recent years, the COVID-19 epidemic has had a great impact on the banking and financial market in general and the payment sector in particular. However, this is also an opportunity for non-cash payment services to

Details

Regulations on the model of citizen’s identity card attached to electronic chips

The form of a Citizen Identification Card (CCCD) under Circular No. 06 has an electronic chip and stores basic information of citizens, with two languages in Vietnamese and English. Circular No. 06/2021 / TT-BCA on the model of citizen’s identity card (Circular 06), including 05 articles and takes effect from January 23, 2021, signed by

Details

Sacombank upgrades the latest online payment security technology

Sacombank is one of the first banks to coordinate with Visa and MasterCard to upgrade the 3D-Secure multi-level protection system version 1.0 to 2.0 according to EMV standards for these cards at the bank. Source: https://thanhnien.vn/tai-chinh-kinh-doanh/sacombank-nang-cap-cong-nghe-bao-mat-thanh-toan-truc-tuyen-moi-nhat-1339802.html

Details

Add security solutions, increase safety in banking transactions

Attach security to digital banking In order to ensure smooth, safe and accurate digital banking services, banks have been constantly “racing” to invest in technology to ensure information safety and security. A survey by the Vietnam Cyber Emergency Response Center shows that 100% of credit institutions invest in security solutions, from basic to advanced. From

Details

Vietnam is about to have domestic credit cards issued by 7 banks in coordination with Napas

There used to be a bank that issued its own domestic credit cards but failed, then they focused on issuing international credit and debit cards on the basis of associating with card institutions such as VISA, Mastercard, JCB … Mr. Nguyen Quang Minh, Deputy General Director of Vietnam National Payment Joint Stock Company (NAPAS), said

Details

Nam A Bank shook hands with Appotapay e-wallet

Nam A Bank and AppotaPay Joint Stock Company have just signed a cooperation agreement, contributing to providing convenient financial services to customers based on the strength of modern technology. Accordingly, Nam A Bank and AppotaPay signed an agreement to sign cooperation services such as: Linking e-wallet, payment gateway, collection on behalf of … At the

Details

50% discount on citizen identification fee with chip

According to Circular 112/2020 / TT-BTC, the citizen identification fee is reduced by 50% for a period of 6 months, from 1/2021 to the end of June 2021. The Ministry of Finance has just issued Circular No. 112/2020 / TT-BTC guiding the collection of a number of fees and charges to support, overcome difficulties and

Details

Convert magnetic card to chip card: Increase utility and security for customers

According to the State Bank of Vietnam (SBV), from March 31, 2021, banks will stop issuing magnetic ATM cards to convert to ATM chip cards, in order to increase convenience and security for customers. row. Talking to Dong Nai Newspaper’s reporter on this issue, Deputy Director of the State Bank of Vietnam, Dong Nai branch

Details

Magnetic cards are slowly “dead”

There have been many commercial banks issuing domestic chip cards to customers and gradually replacing card-accepting devices. Commercial banks are about to issue new domestic cards that must be chip cards, instead of magnetic cards as currently, to ensure the transition of magnetic cards to chips in 2021. This is the highlight at the project.

Details

A bold imprint on Vietcombank card service in 2020

The fact that Visa simultaneously awarded 4 prizes for spending and card payment to Vietcombank once again affirms the quality of card services in particular and Vietcombank’s retail products in general in 2020. As Lao Dong reported, the Visa international card organization has just awarded 4 important award categories in 2020 to the Joint Stock

Details

Agribank actively accelerates the conversion of magnetic cards to chip cards

Converting domestic payment cards from magnetic cards to chip cards is one of the key solutions of Vietnam Bank for Agriculture and Rural Development (Agribank), in compliance with the Project of non-cash payment development the 2016-2020 period of the Prime Minister and Circular No. 41/2018 / TT-NHNN dated December 28, 2018 of the State Bank.

Details

Extend conversion to domestic chips

The State Bank has just released a draft to change the roadmap to convert magnetic tape ATM cards to domestic chip technology in the direction of mandating to stop issuing tape cards from 31.3.2021. Termination of issuance of magnetic tape ATM cards Specifically, extend the term of 100% ATM and card acceptance devices complying with

Details

Payment via e-wallet, how to ensure safety and convenience?

Using electronic wallet to pay online instead of cash is becoming a trend of Vietnamese consumers. But technology wallets are also the target of cyber attacks … E-wallet is the target of hackers According to Mr. Le Anh Dung – Deputy Director of Payment Department (State Bank of Vietnam), the State Bank has licensed 37

Details

Transact safer with ACB Green domestic debit card

Catching up with the 4.0 technology trend, the ACB Green domestic debit card according to VCCS standard (Vietnamese chip card technical standard) is deployed to apply contactless technology (contactless payment) to provide a quality experience. quality for young people. Safety and high security As one of the pioneering banks to grasp the inevitable trend of

Details

Vietbank – A typical innovative product and service bank in 2020

On November 26, 2020, Vietnam Thuong Tin Bank (Vietbank) was honored to receive the Bank with Outstanding Innovative Products and Services 2020 by Vietnam Banking Association and International Data Group (IDG). Awarded. This is a prestigious annual award in the banking community, held from 2012 to present. The award is to honor banks with outstanding

Details

Actively convert magnetic cards to chip cards

The current trend in the world is to convert to chip cards to enhance security and security for bank cards. Vietnam can also not be out of this trend when banks are making positive moves, applying domestic chip card standards throughout the system. Increased utility and safety for the card According to the roadmap set

Details

Domestic chip card BIDV Smart – the official smart card to consumers

Fully converging the most advanced card technologies in the world, BIDV Smart card promises to change the habit of using domestic cards of Vietnamese people. In the booming technology society, technology products called smart become attractive in the eyes of consumers. A smart product that delivers the message of excellence, save time, experience technology and

Details

COVID-19: An opportunity for breakthrough non-cash payment services

According to the Vietnam National Payment Joint Stock Company (NAPAS), by 2020, the number of fast money transfers 24/7 surpassed the number of ATM withdrawals and accounted for nearly 66.6% of the total. the number of transactions processed by the NAPAS system. On November 13, Vietnam National Settlement Joint Stock Company (NAPAS) held the 6th

Details

NAPAS and Vietbank launched domestic prepaid cards with contactless payment in traffic

Vietnam Thuong Tin Bank (Vietbank) and Vietnam National Payment Joint Stock Company (NAPAS) have just officially launched Vietbank NAPAS prepaid cards. This is a line of domestic prepaid cards with chips issued by Vietbank with contactless payment feature in multi-application traffic applying the basic standard of local chip cards of the State Bank. At the

Details

Vietnam Card Day 2020 inspires access to and experience with modern and convenient banking and payment services

“Vietnam Card Day 2020” includes a series of events, starting from November 7, 2020 in Hanoi, with the theme Arousing internal resources from the COVID-19 crisis, promoting the development of non-cash payments. . Under the content direction of the State Bank of Vietnam, ‘‘ Vietnam Card Day 2020 ’is organized by Tien Phong Newspaper and

Details

The bank is racing using chip card technology

Banks are racing to use the technology to convert magnetic cards to chip cards. Accordingly, customers receive many benefits from domestic chip cards. Technology is constantly updating Switching cards from magnetic to chip technology is a requirement for commercial banks in the period 2020-2021. Ms. Nguyen Hong Van – Director of Vietcombank Card Center said

Details

Chip-mounted CCCD cards need to apply advanced technology, ensure security etc.

The Minister of Public Security will decide on the model and material of a citizen’s identity card with electronic chips. At the request of the Prime Minister, the card should apply advanced technology to ensure security and safety. Citizen card with electronic chip will support converting country number On October 7, the Government Office sent

Details

MB can apply Contactless contactless technology

Military Commercial Joint Stock Bank (MB) said that the bank has officially issued a line of domestic debit cards that apply the basic standards of domestic chip cards VCCS. Specifically, according to information from MB, strictly comply with the State Bank’s Circular 41/2018 / TT-NHNN on supplementing the basic standard regulations (VCCS) on chip cards

Details

Successful digital transformation requires a change of mindset

Ms. Nguyen Duc Thach Diem, Member of the Board of Directors cum General Director of Sacombank said that digital transformation is not simply the implementation of new technology projects. Digital conversion is considered a vital issue for banks today. Can you share your views on the importance and goal of digital transformation at Sacombank? Digital

Details

All 6 types of papers are about to change, the people of the country benefit

In the coming time, it is expected that there will be a “revolution” involving a series of important papers for each citizen – a new step in the efforts to reform administrative procedures of the authorities. permission. 1. Identity of the citizen attached to the chip The Law on Citizen’s Identity stipulates that, starting from

Details

Add a lock for more safety when paying for your card

Some regulations are expected to be added by the State Bank to ensure safer and more secure card payments. The State Bank is currently drafting an amendment to Circular 47 providing technical requirements for safety and security with facilities for bank card payments. Accordingly, for operating accounts and administrative accounts, banks and payment intermediaries need

Details

VPBank and Visa cooperated with Shopee to launch credit cards

VPBank Shopee credit cardholders will enjoy many benefits such as free shipping, refund, online gift collection … The card opening process is 100% digitized, users can register right on the Shopee app and are provided with a virtual card by VPBank to spend after only one to 2 hours. VPBank – Shopee cardholders will enjoy

Details

Chip-mounted citizen identification: Who must exchange?

As the previous information has given, the citizen’s identity will be changed to a new model with a chip in the near future. At that time, did all people have to change to this new card model? Expected to issue citizen ID with chip in 11/2020 Recently, the Prime Minister has signed Decision No. 1368

Details

The first Vietnamese bank allowing customers to use domestic cards for transactions in Korea

In addition to international debit cards or credit cards, TPBank has allowed all domestic cardholders to make instant payment and withdrawal transactions in the Korean market. Tien Phong Commercial Joint Stock Bank (TPBank) has successfully implemented the project of 3-party connection between TPBank, Vietnam National Payment Joint Stock Company (NAPAS) and BC Card Company –

Details

Baoviet Bank converts magnetic cards to domestic chip cards

The digitization of domestic cards of Baoviet Bank aims to ensure transaction safety for customers, and prevent fraud and fraud. From September 14, Baoviet Bank completed the conversion of magnetic cards to domestic chip cards. Compared with magnetic cards, the domestic chip card line fully meets the elements of international EMV standards, the bank said.

Details

Cashless transactions increased impressively

In the first 6 months of 2020, the total amount and total value of non-cash payment transactions via the NAPAS system increased by 138% and 140.5%, respectively, compared to the same period last year. To contribute to promoting non-cash payments, exchanging with Tuoi Tre, Mr. Nguyen Dang Hung, deputy general director of Vietnam National Payment

Details

Conversion of chip cards – one of the major goals of the State Bank

According to the SBV’s roadmap specified in Circular No. 41/2018 / TT-NHNN, by the end of 2020, 100% of ATMs and card acceptance devices at point of sale operating in Vietnam of card payment institutions must Comply with local standard chip card. The first domestic chip cards from Vietnam were officially launched on May 28,

Details

Translation COVID-19 slows down the process of converting magnetic cards to chip cards

Due to the impact of the COVID-19 epidemic, the roadmap for conversion of magnetic cards to chip cards is currently significantly affected, which may be difficult to achieve as planned. Chip card technology using base standards (VCCS) is being invested by banks to focus on safety and integration of utilities for customers when using. However,

Details

Cashless payments increasingly prevail

After years of getting used to cashing out, many people have turned to non-cash payments. It is forecasted that this trend will increasingly prevail in 2020 when 63% of adults in Vietnam have a bank account. Vietnam National Payment Company (Napas) said that in 2019 Napas switch systems grew 80.2% in the total number of

Details

Convert chip cards: Determined determination, lack of time

The State Bank of Vietnam has set a roadmap by the end of 2021, 100% of bank cards and devices that accept cards in Vietnam must be converted to chip standards. Banks are determined to convert cards even though there are still some problems. Talking to Tuoi Tre, Mr. Nguyen Minh Tam – Deputy General

Details

QR code payment – New trend of modern young people

At any location, even without carrying a wallet, cash or bank card, you can confidently pay the bill in a snap with QR code (payment by QR code) via mobile banking. This trend has become a modern payment trend for many young people today. “Very fast, every time I go out to eat and drink,

Details

What is the Napas Card (National Payment Services)? Features of Napas card

Napas Card (English: National Payment Services) is a card brand issued by Vietnam National Payment Corporation. Napas Card (National Payment Services) Concept The Napas card in English is National Payment Services. Napas Card is a card brand issued by Vietnam National Payment Joint Stock Company. With similar features to domestic ATM cards, Napas card helps

Details

VIETCOMBANK LAUNCHED SECURE 3D SECURITY FOR INTERNATIONAL DEBIT CARD

In order to enhance the security when paying online by card, from October 1, 2019, Vietcombank officially implemented the 3D Secure security feature for international debit cards. So far, Vietcombank has implemented 3D Secure for all international credit and debit card products bearing the Visa / Mastercard / Amex / JCB brands issued by Vietcombank.

Details

Reducing international card fees will promote non-cash payments in Vietnam

According to the Vietnam Banking Association, currently, Vietnamese banks are paying for Visa and MasterCard 3-4 fees per transaction. The situation of “superposition charge” partly affects the card business of banks, hindering the process of promoting non-cash payment. According to statistics, currently Vietnamese banks are paying for Visa, MasterCard 3-4 charges per transaction. The situation

Details

More than 1 million magnetic stripe cards have changed to chip cards

Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) said that the bank has converted over 1 million magnetic cards to chip cards According to Ms. Nguyen Hong Van, Director of Vietcombank Card Center, from September 2019, Vietcombank was one of the first banks to deploy new issuance and convert magnetic cards to contactless

Details

It is difficult for Vietnamese banks to reduce international card fees

Vietnamese banks are proposing international card issuers such as Visa, MasterCard to reduce card fees when revenue from this activity plummets due to the impact of epidemics, but the possibility of fee reduction is not high. The Vietnam Banking Association (VNBA) said that the Covid-19 pandemic was complicated and greatly affected the business activities of

Details

Vietcombank continues to offer free conversion from magnetic stripe card to chip card

Conversion of cards from technology to chip technology is a requirement for commercial banks (commercial banks) in the period of 2020-2021. This is the opinion of Ms. Nguyen Hong Van – Director of Vietcombank’s Card Center when discussing the bank’s plans and the challenges of implementing chip cards. As a pioneer bank and the implementation

Details

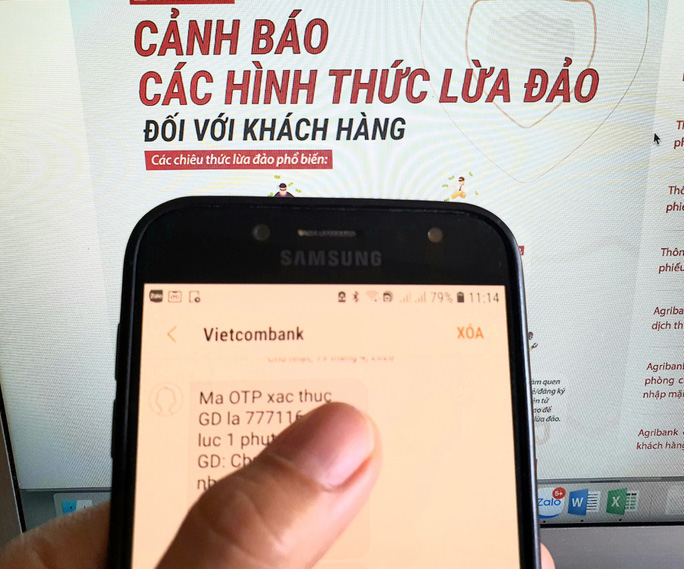

Add a bank alert trick trick to steal money in the account

Although banks have repeatedly warned of high-tech criminals cheating on OTP codes, requiring login to fake bank websites to steal customers’ money, there are still many people trapped. Agribank has continued to warn tricks of branding, website, relatives, bank officials, postal staff, law enforcement agencies … with many scenarios to steal customers’ account information. ,

Details

5 Golden rules to help you use your ATM card safely

Most ATM cards in use today mainly use magnetic technology. With this technology, the card information has been hacked and changed easily … The advent of ATM has created a major breakthrough, completely changing the trading habits of Vietnamese people. Until now, the ATM card has become a familiar tool, “the object of separation” with

Details

TPBank spent tens of millions of dollars upgrading eBank applications

The bank calls the new version of internet banking a future digital banking platform, integrating many new technologies such as AI, machine learning … eBank X – the latest version of Internet Banking of TPBank was officially put into operation on December 6. The newly introduced upgrade has many significant improvements compared to the old

Details

Joint venture bank entered the domestic Premium chip card issuance

Premium chip card is connected to payment account. So customers can use to withdraw money, transfer money, pay for goods, online shopping at the payment website via Napas portal. Comply with Circular No. 16 / KH-NHNN dated December 30, 2015 on “converting magnetic cards into chip cards” and Circular 41/2018 / TT-NHH dated December 28,

Details

Promote comprehensive cash-free economic development platform

Non-cash payment is an inevitable development trend that will create a multidimensional impact, both bringing convenience to the people, creating economic growth momentum and being encouraged to promote. In early 2020, the Prime Minister approved the National Comprehensive Financial Strategy to 2025, with orientations to 2030 in Decision 149 / QD-TTg. The strategy is considered

Details

Visa and NextPay promote cashless payment in Vietnam

Visa – the digital payment network and NextPay – a provider of digital transformation solutions for small and medium enterprises (SMEs) in Vietnam and signed a strategic agreement to promote cashless payment in Vietnam . The goal of the joint agreement of Visa and NextPay is to develop and expand the network of digital payment

Details

Virtual Visa electronic identification card: the first digital banking product launched

In the era of rapidly growing 4.0, the financial and banking industry is also actively transforming, especially the application of the latest achievements of technology, electronic payment development and digital banking. . Undeniably, digital banking is the development trend of the world in the era of increasingly modern technology. The emergence of digital banking brings

Details

Pressure to convert magnetic card into chip card

Vietnam National Payment Joint Stock Company (NAPAS) has just speeded up the roadmap to reduce money transfer fees from 47 to 100% for banks. This is a good sign for the market but whether banks will reduce fees for customers or not is unknown. Reducing fees, speeding up the conversion of magnetic cards to chips

Details

The bank must periodically report the results of conversion of magnetic card to chip card

The State Bank of Vietnam proposed the issuance, payment, switching of electronic cards … seriously organized the application of domestic standard of chip card base. The State Bank of Vietnam (SBV) has just issued a written request for card issuers, card payment organizations, card switching organizations and electronic clearing organizations to conduct card implementation contents.

Details

Electronic payment with public services: Benefit both ways

Techcombank is a typical commercial bank going early and comprehensively, leading the promotion of electronic payment channels, increasing utilities for people. At the beginning of 2020, the Governor of the State Bank of Vietnam (SBV) issued Directive No. 01 / CT-NHNN requiring the banking industry to speed up non-cash payments, especially via bank payment for

Details

Be cautious of the wave of personal credit default due to the Covid-19 epidemic

The Covid-19 epidemic caused heavy losses to production and business activities, and accordingly, the number of unemployed also increased sharply, all cautious for credit card default may not be redundant. Fall into the “debt net” for using a credit card NTH, a new employee at a joint-stock commercial bank in Hai Ba Trung, Hanoi, said:

Details

What is the difference between a Mastercard and a Visa card? What type of card should use?

Mastercard and Visa cards are two popular international payment cards lines in the world today. But what is the difference between a Mastercard and a Visa card that is so popular? Join us in the article below. 1. Differentiate Mastercard from Visa card Visa card is an international payment card issued by Visa International Service

Details

Mastercard is committed to traveling with Vietnam to create a world that is not limited by cash

Vietnam is really moving ahead of more developed countries like Singapore and Malaysia in electronic payment, with the fastest mobile payment growth in the world, from 37% in 2018 to 61% in 2019. “Within 6 years, the scale of the Vietnamese e-commerce market is expected to be the second in Southeast Asia. This is really

Details

Payment trends Contactless card to the throne

With many utilities and high security, contactless cards (contactless cards) are forecast to be the payment trend in the near future, especially in the context of COVID-19 epidemic situation is complicated and concerns. about spreading the disease when using cash The World Health Organization (WHO) recommends using contactless payment – contactless or using smartphone applications

Details

Surf, wave lightly the card can be paid on Vietbank Digital

Facing the complicated situation of Covid-19, Vietbank transactions will switch to online or limit contact to ensure safety for themselves, their families and the community. Recently, Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank) has successfully implemented CHIP / EMV cards, launched contactless payment via Contactless technology for domestic and international cardholders including customers. issuing

Details

Covid-19 season, super convenient shopping thanks to online payment

From shopping all kinds of goods, ordering food regardless of the morning … to paying the daily bills through online utility applications are all very popular in modern life, especially in times of social isolation space today. No need to step out of the house, just a smartphone or a computer, you can freely choose

Details

TPBank pioneered the application of digital technology to card products

Possessing a variety of security authentication methods to ensure safe, fast transactions, streamlined processing, etc., TPBank is affirming its leading position in the digital card trend in the Vietnamese card market. Electronic PIN, 3D Secure authentication method or contactless payment feature are digital technologies applied by Tien Phong Commercial Joint Stock Bank (TPBank) several years

Details

Conversion of electronic health insurance card: What do people get?

During the transition period to electronic cards, Vietnam Social Insurance still ensures full benefits of patients From January 1, 2020, the Vietnam Social Insurance agency will issue an electronic health insurance card with a chip attached to the participants of health insurance instead of paper cards. Also from this point, the Ministry of Health has

Details

What’s new in 2020 health insurance card?

As previously reported, from January 1, 2020, the social insurance agency issues an electronic health insurance card for participants. So, what are the characteristics of this card? Electronic health insurance card with facial recognition By January 1, 2020, the social insurance agency must issue electronic health insurance cards to the participants of health insurance. At

Details

The Covid-19 pandemic created opportunities to promote the development of electronic payments

The time of the Covid-19 pandemic spread was a difficult period for both the economy in general and the banking and financial sector in particular, but it also created an opportunity to promote the growth of electronic payment. . Financial institutions, banks and Fintech companies that take advantage of this difficult period to turn into

Details

Contactless payment technology helps prevent Covid-19

Vietbank applies contactless payment technology to cardholders to ensure safety for customers and the community in Covid-19. According to experts, in the context of the current epidemic, contactless, cashless payments should be encouraged and promoted to ensure people’s daily needs, and contribute to the prevention of Covid-19. . Vietbank has successfully implemented EMV chip card

Details

Promote digital transformation

The Covid-19 pandemic has and will change many things. Regarding digital conversion, according to Mr. Ousmane Dione, Director of the World Bank in Vietnam, the response to the Covid-19 epidemic is a catalyst to help Vietnam perform faster. At the online press briefing of the National Steering Committee for Prevention of Epidemic Covid-19, the Central

Details

Vietcombank miễn phí phát hành thẻ ghi nợ

Ngân hàng Vietcombank vừa triển khai chương trình “Miễn phí phát hành thẻ ghi nợ” nhằm tri ân khách hàng. Theo đó, chương trình sẽ diễn ra từ ngày 1/4 đến hết ngày 31/05 nhân dịp kỷ niệm 57 năm thành lập Vietcombank. Đối tượng áp dụng miễn phí là khách hàng chưa từng có thẻ ghi nợ nào

Details

Did you know that contactless swipe?

Contactless payment was born, contributing to increasing the confidentiality and security of customers’ information during the transaction process, limiting customers being taken advantage of. Following the payment trend with QR Code, Contactless Payment is a modern payment method, which has just been deployed in Vietnam market recently. Compared with conventional cards, Chip cards with Contactless

Details

Electronic payments spike in Covid-19

Users switch to payment via cards, mobile applications, QR codes … to increase safety and convenience in Covid-19, and enjoy incentives from the bank. Never used a banking application to pay bills, Ms. Thu Hong (District 8, Ho Chi Minh City), surprised by the convenience of this method. “The recent payment of utility bills, for

Details

The bank changes itself in the digital race

Nam A Bank offers robots and virtual assistants to serve customers while simultaneously improving the eBanking ecosystem, providing a multi-utility experience for customers. In the context of technology development, digital banking application is an indispensable choice of banks, in order to provide safe, effective financial services to meet the diverse needs of users. This is

Details

Reduce the risk of transaction room payment COVID-19

Implementing Directive No. 01 / CT-NHNN of the Governor of the State Bank of Vietnam (SBV) requires the banking sector to step up non-cash payments, especially through bank payments for public services, for Up to this point, Techcombank is a typical commercial bank leading the promotion of non-cash electronic payment channels to both increase convenience

Details

Card payment: Swiping cards, Inserting chip cards, and paying with smartphones, which form should I use?

Currently there are many ways to pay with a POS card when we buy, shop, … But in Vietnam, there are 3 most common payment actions are Coffee card Insert the card with the chip Add a card to Smartphone to pay (Currently only Samsung Pay) I share a bit about the action of the

Details

LAUNCHING CHIP ATM TECHNOLOGY WITHOUT CONTACT

Contactless ATM Chip Card “officially launched with many outstanding utilities, bringing optimum convenience and safety for users: – Card information is encrypted in security in Chip, protecting customers from fraud and fraudulent transactions; – Make payment easier and faster with “Touch payment” technology – Certified with VCCS Chip card standard * (* VCCS: Chip card

Details

From 2020, there is no need for personal documents for medical examination and treatment with health insurance

For many years, identity card or other personal documents have been an integral part of medical examination and treatment records of health insurance. However, from next year, when medical examination and treatment, people have been able to ignore this type of paper. Medical examination and treatment procedures with current health insurance According to Article 15

Details

EMV chip card: Overview of what you need to know

ATM card using electronic chip technology, EMV standard, has been officially launched at 7 commercial banks in Vietnam. To help readers use it conveniently and safely, thoibaonganhang.vn introduces some information and notes for this product. Technology of Vietnamese chip cards Chip card is a type of card on which the card has an electronic chip.

Details

Vietnam will soon become a cashless country

That is the affirmation of Mr. Safdar Khan, a veteran member of Mastercard, who has just taken on the role of the Group’s head of emerging markets in Southeast Asia. According to Nikkei, in Asia, in the battle of electronic payment, Visa and Mastercard are facing many challenges when credit cards seem to be losing

Details

PVcomBank converts ATM cards made from magnetic tape technology to EMV chip technology

Vietnam Joint Stock Commercial Bank (PVcomBank) has just converted all bank ATM cards made from magnetic tape technology to the most advanced EMV chip technology, helping customers to trade safely and enjoy many current payment utilities. Great. Domestic card (ATM) is one of the most popular payment methods in Vietnam today. Cardholders can use the

Details

Current situation and solutions for developing digital banks in Vietnam

The rapid development of modern information technology creates digital banking – a new trend for future retail banks. Because it is quite new in Vietnam compared to developed countries, the number of digital banks in Vietnam is still modest. Digital banking offers new opportunities for commercial banks but also presents challenges to overcome for regulators.

Details

Paying by QR code is about to explode

According to a statistic, QR code payment is currently implemented by 18 banks such as BIDV, VPBank, Vietcombank, VietinBank, Agribank, TPBank, Maritime Bank, SCB, SHB …; Over 20,000 points use QR codes according to the common standards of the applicable banks, with over 8 million users. Benefits for consumers, businesses and banks will help QR

Details

Cash withdrawal from credit cards via POS: It’s illegal and risky

Banks need to propagate to customers that credit cards cannot be used to withdraw money through short transactions, because it is illegal. Currently, cash withdrawal services from credit cards are very popular. Accordingly, there are a number of companies that have cooperated with banks to apply the Visa card payment channel to accept payment of

Details

Contactless debit card payments grew sharply

The popularity of contactless payments has boosted the value of debit card transactions by 18.5% in December – the peak shopping month of the year-end season. Statistics from the Central Bank show that debit card transactions at PoS points increased by nearly 20% to 4.8 billion euros in December, compared to the same period last

Details

Chip cards offer additional opportunities to accelerate cashless payments

Vietnam National Payment Joint Stock Company (Napas) has officially broadcasted information to start converting magnetic cards into chip cards. This is an effort in the direction and administration of the State Bank of Vietnam as well as Napas – the unit assigned to be the focal point in the plan to convert magnetic cards to

Details

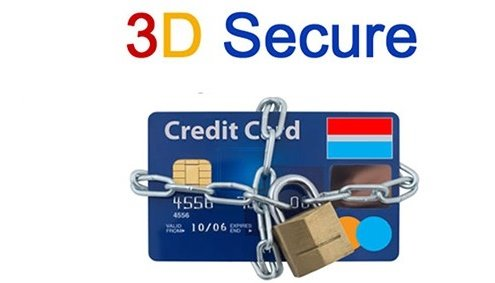

What is 3D security on bank cards – Safety – 2020

Many online shopping fans come across a 3D-Secure security system specifically developed for Visa international payment systems and then for MasterCard users. But what is 3D-Secure? How to connect it? What are its advantages and disadvantages? Is it possible to ignore it? Does he save from the intrigue of intruders? Where can I find 3D-Secure

Details

Advantages of 3D-Secure 2.0 security technology

3D-Secure is an extra layer of protection for Vietcombank cardholders to enhance safety, security and convenience when making transactions online. With this method, when performing transactions on e-commerce websites, besides normal authentication steps, Vietcombank will send an additional one-time transaction password (OTP) via text message or email for customers to enter and complete the transaction.

Details

Opportunities to promote universal cashless payment

Before the event of online payment epidemic, it proved the advantage and this is an “opportunity” to develop non-cash payment methods. Does Vietnam take advantage of this opportunity or miss it? Special opportunity According to Minister of Information and Communications Nguyen Manh Hung, the Covid-19 translation is posing a great challenge for the country, because

Details

Vietbank Digital: Towards a society without cash

Vietbank Digital is directing users to switch to a cashless payment society, while contributing to preventing the spread of the covid epidemic 19. Exempting all registration fees, annual fees, account management fees and reducing interbank transfer fees along with contactless payment technology, Vietbank Digital is directing users to switch to a cashless payment society. It

Details

Dịch Covid-19 ảnh hưởng thế nào đến ngành công nghệ toàn cầu?

Virus Corona chủng mới gây dịch Covid-19 đang giáng một đòn nặng vào nền kinh tế toàn cầu với hậu quả cực kỳ nghiêm trọng, vượt xa các trận dịch trước đây. Năm 2003, khi đại dịch SARS bùng phát ở Trung Quốc rồi lan ra cả thế giới (làm 8.096 người nhiễm bệnh và gây tử vong cho 774 người) đã làm

Details

BIOLOGICAL TECHNOLOGY: SECURITY COURSE OF BANKING IN THE FUTURE

The following article discusses IDEX Biometrics ASA’s Vice President, David Orme about the concerns of Generation Z (those born from 1995 onwards) on online banking security. and the importance of biometric technology to the younger generation. The payment ecosystem continues to grow due to the ever-increasing interest in payment methods. Today, Generation Z is considered

Details

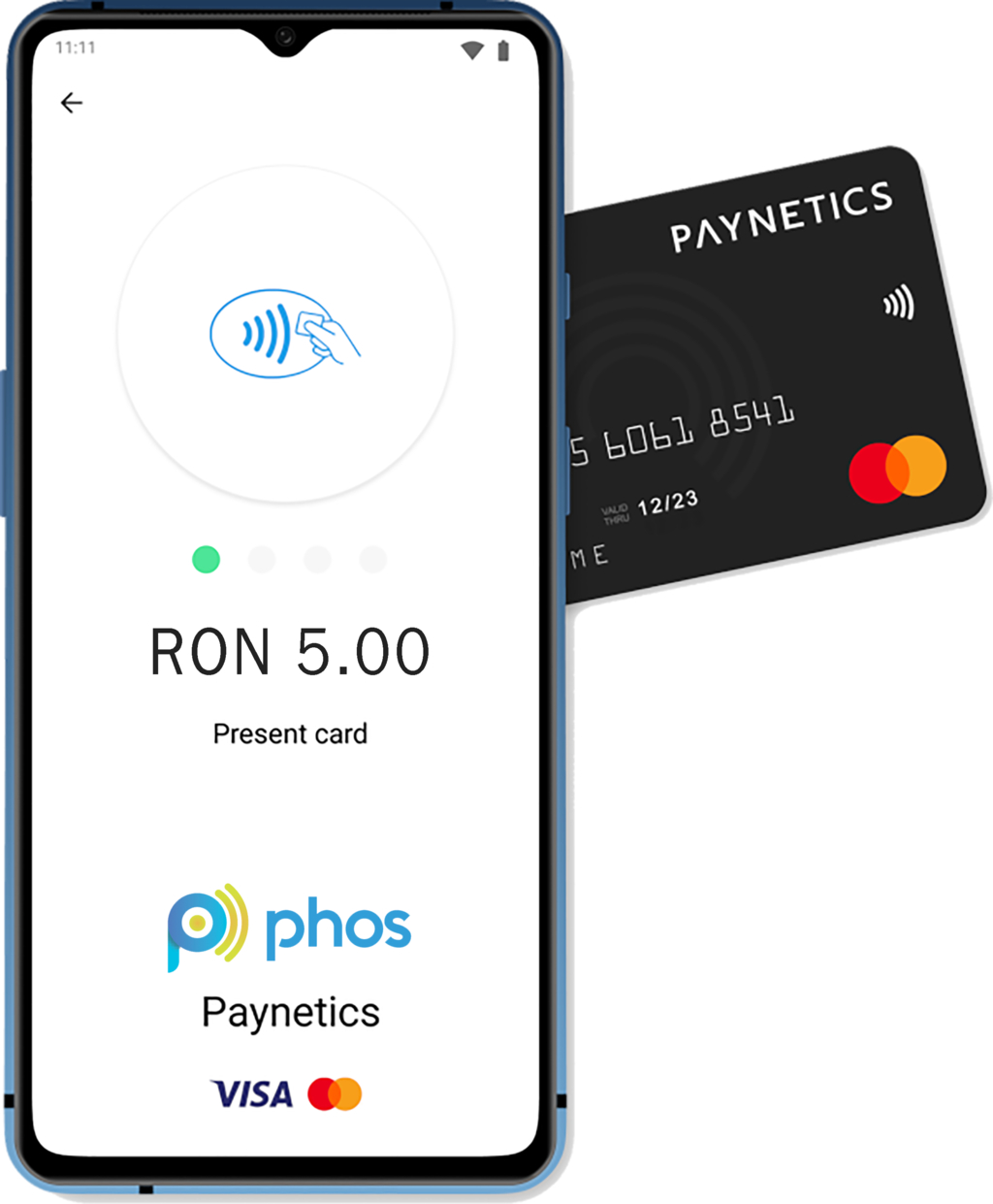

4 EUROPEAN COUNTRIES PAYMENT WITHOUT EXPOSURE WITHOUT ANDROID NFC AND PHONE

Merchants in 4 countries including the UK, Germany, Bulgaria and Romania will participate in testing the new mobile POS service (mPOS) to allow contactless payments to be accepted on Android mobile devices without the need for additional any “lock or hardware”. Mastercard has partnered with new software companies Phos and Paynetics specializing in mobile POS

Details

COVID-19 Translation: The State Bank implements solutions to support customers

On February 24, the State Bank of Vietnam issued Document No. 1117 / NHNN-TD on the implementation of customer support solutions due to the impact of the COVID-19 epidemic. Accordingly, the current acute respiratory infection due to the new strain of Corona virus (outbreak of COVID-19) is complicated, affecting production and business activities, thereby affecting

Details

3D-Secure – secure technology for card transactions

With outstanding advantages of safety – security – convenience, 3D-Secure has been well received and used by Vietcombank cardholders. Recently, the Bank for Foreign Trade of Vietnam (Vietcombank) has invested heavily in technology systems, prioritizing the use of infrastructure and application of the most advanced, modern and most secure technology, ensuring transaction support. Card payment,

Details

Unknown things about 3D Secure security solution

3D Secure is the leading secure online payment security solution today, helping customers minimize risks such as fraud, card information theft … 3D Secure is the most advanced, secure online payment security solution today. The authentication of online payment transactions via OTP messages (One Time Password – one-time password) allows Visa cardholders to actively authenticate

Details