Face recognition and fingerprint authentication are two of the digitized solutions being promoted by banks during this time.

Instead of taking numbers, waiting, hand-filling paper forms, presenting identification documents, Mr. Nguyen Ngoc Anh can easily perform the deposit, cash withdrawal and other procedures at the counter quickly. Because all your needs are known by the teller.

By withdrawing money at an ATM with a magnetic card, an intruder can steal information and make a fake card. Along with the replacement of chip cards, newer ATMs at payment stores will be integrated with new authentication methods, without using physical cards.

TPBank currently has more than 200 automatic banks (LiveBank) nationwide. According to the bank’s leader, the authentication of transactions by face recognition is a way to ensure security, avoiding the use of fraudulent identity cards, fake identities to conduct fraudulent transactions at banks. line.

Face recognition and fingerprint authentication are just two of the digital solutions being promoted by banks during this time. There are banks that offer interconnection solutions between banks and hospitals to support patients.

In the past, digital banking centers of many banks have been created to create new products and services or combine with Fintech companies to create many technological solutions. Digitization from internal operations to transactions with customers is the goal of the banking system this year.

(Source: VTV)

Other News

Converting magnetic card to chip card: Increasing security and safety when using the card

Under the direction of the State Bank, Vietnam Bank Card Association (VBCA) in collaboration with Vietnam National Payment Corporation (NAPAS) officially launched domestic chip card products. The Securities Investment Newspaper had an interview with Mr. Tran Cong Quynh Lan, Deputy General Director of VietinBank, one of the first 7 banks to deploy this event. Switch

Details

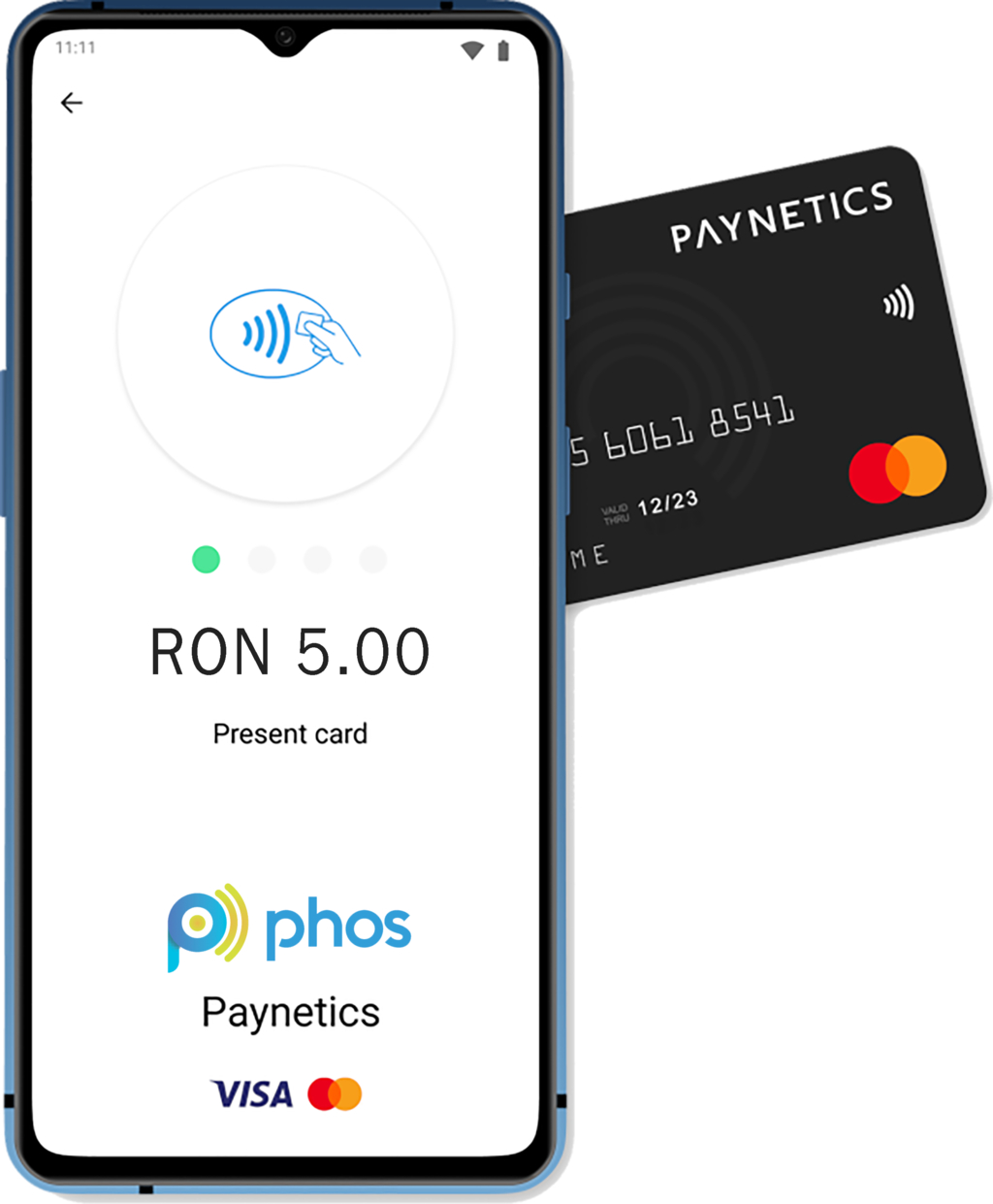

4 EUROPEAN COUNTRIES PAYMENT WITHOUT EXPOSURE WITHOUT ANDROID NFC AND PHONE

Merchants in 4 countries including the UK, Germany, Bulgaria and Romania will participate in testing the new mobile POS service (mPOS) to allow contactless payments to be accepted on Android mobile devices without the need for additional any “lock or hardware”. Mastercard has partnered with new software companies Phos and Paynetics specializing in mobile POS

Details

Accept ‘team’ cost for customer experience using chip card

At the request of the State Bank of Vietnam (SBV), by the end of 2019, at least 30% of ATM cards and 50% of POS devices at points of sale in circulation throughout the country must comply with the standards. base on domestic chip card standard. However, the biggest problem with banks when switching from

Details

Vietnam is ready to convert magnetic cards into local chip cards

Stable, safe, smooth conversion and ensure the interests of card holders, aiming to convert all bank cards from magnetic cards to domestic chip cards using safe, secure and convenient chip technology Useful, multi-application for all Vietnamese people. Under the direction of the State Bank, Vietnam Bank Card Association (VBCA) in collaboration with Vietnam National Payment

Details

Transact safer with ACB Green domestic debit card

Catching up with the 4.0 technology trend, the ACB Green domestic debit card according to VCCS standard (Vietnamese chip card technical standard) is deployed to apply contactless technology (contactless payment) to provide a quality experience. quality for young people. Safety and high security As one of the pioneering banks to grasp the inevitable trend of

Details

Vietbank Digital: Towards a society without cash

Vietbank Digital is directing users to switch to a cashless payment society, while contributing to preventing the spread of the covid epidemic 19. Exempting all registration fees, annual fees, account management fees and reducing interbank transfer fees along with contactless payment technology, Vietbank Digital is directing users to switch to a cashless payment society. It

Details